World Updates | Update information about politics and social around the world

Dividend Payment Date: A Comprehensive Guide For Investors

Editor's Notes: "Dividend Payment Date: A Comprehensive Guide For Investors" have published on [Published Date]. Because everyone interested to know more about dividend payment date.

Dividend Payment Date FAQ

Understanding dividend payment dates is crucial for investors seeking regular income from their investments. This FAQ aims to provide comprehensive answers to common questions surrounding dividend payment dates, empowering investors to make informed decisions.

Stock Dividend Payment Dates 2024 - Peg Shaylynn - Source kirstinwjenny.pages.dev

Question 1: What is a dividend payment date?

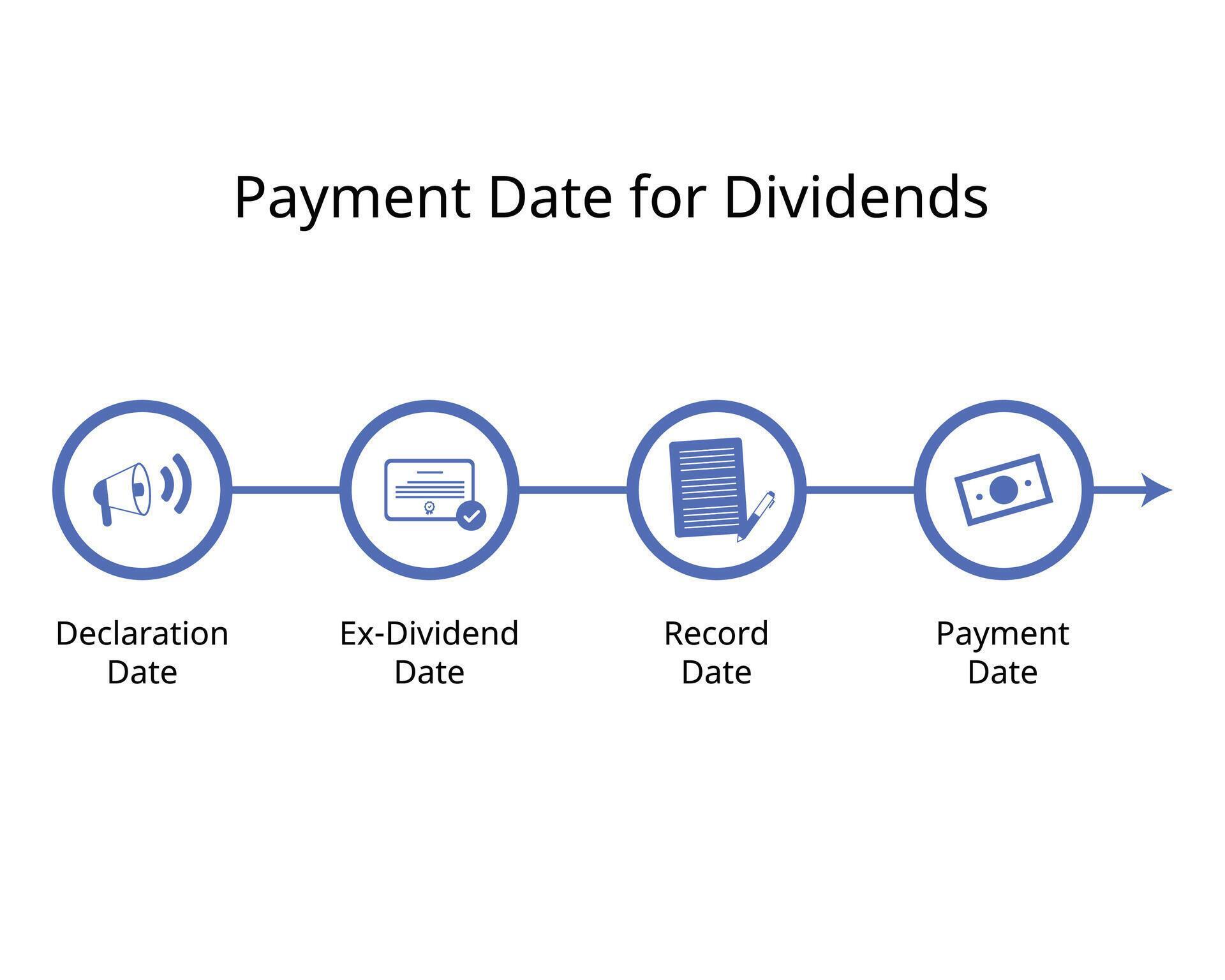

The dividend payment date is the specific date on which a company distributes its dividend to eligible shareholders. It typically falls several days or weeks after the company's board of directors declares the dividend.

Question 2: How do I know the dividend payment date for a stock I own?

The dividend payment date is publicly disclosed by the company and can be found on the company's website, financial news websites, or through your brokerage account.

Question 3: What happens if I sell my stock before the dividend payment date?

To receive the dividend, you must be the registered owner of the stock by the record date, which typically precedes the payment date. If you sell your stock before the record date, you will not be entitled to the dividend.

Question 4: What is the impact of stock splits on dividend payments?

Stock splits increase the number of shares outstanding without affecting the total value of your investment. As a result, dividend payments per share may decrease proportionally after a stock split, while the total dividend payout remains unchanged.

Question 5: How are dividend payments taxed?

Dividend payments are generally taxed as ordinary income and are subject to the individual's applicable tax bracket. However, qualified dividends from U.S. companies or certain foreign corporations may be eligible for more favorable tax treatment.

Question 6: Why do dividend payment dates sometimes change?

Dividend payment dates may change due to various reasons, such as changes in the company's financial condition, mergers or acquisitions, or regulatory requirements. Companies typically provide advance notice of any changes to their dividend payment schedule.

Understanding dividend payment dates is essential for investors seeking consistent income from their portfolios. By being aware of these dates and key considerations, investors can maximize the benefits of dividend-paying stocks and make informed investment decisions.

Next: "Dividend Reinvestment Plan: A Comprehensive Guide"

Tips

Dividend payment date is crucial information for investors seeking regular income. Understanding the timing of dividend payments can optimize investment strategies and maximize returns.

Tip 1: Check the Company's Dividend Calendar

Many companies publish their dividend calendars, outlining the dates on which they declare, pay, and record dividends. Access these calendars through the company's website or financial portals.

Tip 2: Consider Settlement Date

The dividend payment date for cash dividends is typically two business days after the record date. Stocks purchased on or before the ex-dividend date will be eligible for the dividend. However, remember the settlement time for stock trades (usually two business days) when determining the window for purchasing to receive the dividend.

Tip 3: Monitor Dividend Announcements

Companies typically announce their dividend payments in press releases or financial news outlets. Stay informed about dividend declarations to plan for upcoming payments. Dividend Payment Date: A Comprehensive Guide For Investors

Tip 4: Calculate Dividend Yield

The dividend yield, calculated by dividing the annual dividend per share by the current market price of the stock, provides insight into the income potential of an investment. Comparing dividend yields can help investors identify high-yielding stocks.

Tip 5: Diversify Dividend Investments

Diversifying dividend investments across different companies or sectors can mitigate risk and ensure a steady income stream, reducing the impact of potential fluctuations in any single company's dividends.

Understanding dividend payment dates empowers investors with the knowledge to optimize their income-generating strategies. By following these tips, investors can stay informed, time their investments effectively, and maximize their returns through dividends.

Dividend Payment Date: A Comprehensive Guide For Investors

In the realm of dividend-paying stocks, the dividend payment date holds immense significance. In essence, it marks the day when a company distributes a portion of its profits to its shareholders. Understanding the key aspects of this date empowers investors to optimize their investment strategies and maximize returns.

These key aspects of dividend payment dates are interconnected and crucial for investors. By understanding the timing and nature of dividends, investors can plan their investment decisions, such as buying shares before the ex-dividend date to qualify for the payout or selecting stocks with consistent or special dividend policies. Furthermore, tracking the dividend payment dates helps investors monitor their portfolio performance and identify long-term investment opportunities.

Sia Dividend Payout Date 2024 Record Date - Kira Serena - Source janinayarabella.pages.dev

Dividend Payment Date: A Comprehensive Guide For Investors

The dividend payment date is the date on which a company pays dividends to its shareholders. Dividends are paid out of a company's profits and are typically paid quarterly, semi-annually, or annually. The dividend payment date is important for investors to know because it is the date on which they will receive their dividend payments.

Dividend Quotes. QuotesGram - Source quotesgram.com

There are a number of factors that can affect a company's dividend payment date. These factors include the company's financial performance, the company's dividend policy, and the company's cash flow. Companies that are performing well financially are more likely to pay dividends. Companies that have a consistent dividend policy are more likely to pay dividends on a regular schedule. And companies that have strong cash flow are more likely to be able to afford to pay dividends.

The dividend payment date is an important factor for investors to consider when making investment decisions. Investors should consider the company's financial performance, dividend policy, and cash flow when evaluating a company's dividend potential.

In addition to the factors listed above, the dividend payment date can also be affected by the following:

- The company's fiscal year-end

- The company's dividend reinvestment plan

- The company's stock split history

Investors should be aware of all of these factors when trying to determine a company's dividend payment date.

Conclusion

The dividend payment date is an important factor for investors to consider when making investment decisions. Investors should consider the company's financial performance, dividend policy, and cash flow when evaluating a company's dividend potential.

The dividend payment date is a key component of a company's dividend policy. It is the date on which shareholders receive their dividend payments. The dividend payment date is important for investors because it allows them to plan for the receipt of their dividend payments.