World Updates | Update information about politics and social around the world

Forex Currency Rates: Real-Time USD Exchange Rates And Analysis

Forex Currency Rates: Real-Time USD Exchange Rates and Analysis is a valuable tool for anyone involved in international business or travel, providing up-to-date information on exchange rates and expert analysis to help users make informed decisions.

Our team of experts has analyzed the latest data and trends to bring you this comprehensive guide to Forex Currency Rates: Real-Time USD Exchange Rates and Analysis. Whether you're a seasoned trader or a first-time traveler, this guide will provide you with the information you need to make smart decisions about your currency exchange.

Key Differences or Key Takeaways

Transition to main article topics

FAQs

This section provides answers to frequently asked questions regarding forex currency rates and analysis. It aims to dispel common misconceptions and provide concise information for a better understanding of this complex financial market.

Market forex resources currency exchange rates, how to recycle plastic - Source gedyfej.web.fc2.com

Question 1: What are forex currency rates?

Forex currency rates represent the exchange rate between two currencies. They determine how much of one currency is worth in terms of another and serve as the basis for international trade and financial transactions.

Question 2: How are forex currency rates determined?

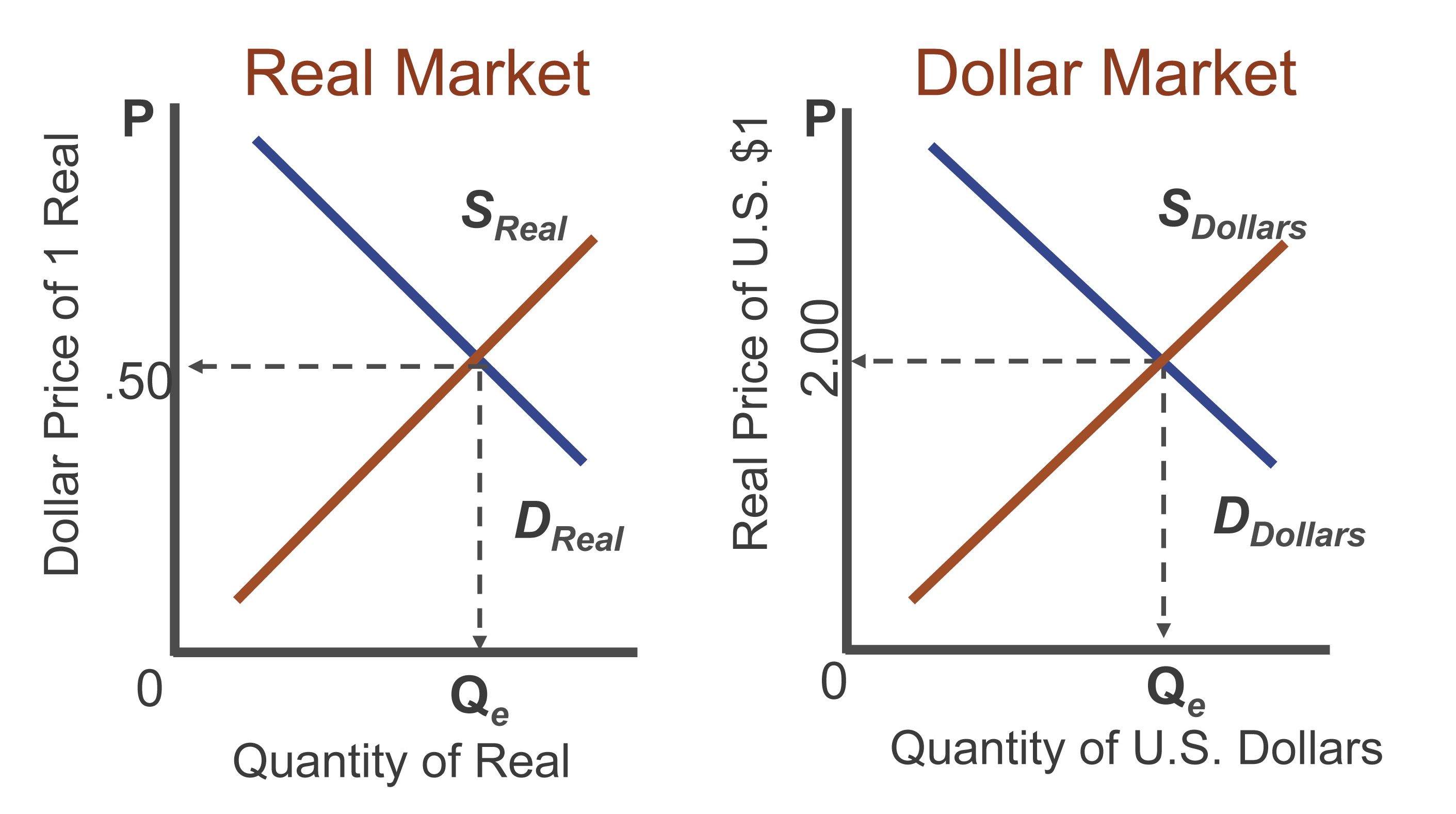

Forex currency rates are influenced by a multitude of macroeconomic factors, including economic growth, interest rates, inflation, and political stability. Market forces such as supply and demand also play a significant role in determining rates.

Question 3: What is the difference between spot and forward rates?

Spot rates are the current exchange rates for immediate settlement, while forward rates are used to hedge against future currency fluctuations. Forward rates reflect expectations about future spot rates based on market conditions.

Question 4: How can I analyze forex currency rates?

Forex currency rate analysis involves examining historical data, economic indicators, and technical indicators. It helps identify potential trends and predict future movements in currency values.

Question 5: What is the impact of geopolitical events on forex currency rates?

Geopolitical events, such as wars, trade disputes, and natural disasters, can significantly impact forex currency rates. They introduce uncertainty into the market, causing volatility and potential shifts in currency values.

Question 6: How can I stay informed about forex currency rates and analysis?

Several reputable sources provide up-to-date information on forex currency rates and analysis, including financial news outlets, central banks, and specialized websites. Stay informed to make well-informed decisions when dealing with foreign currencies.

In conclusion, understanding forex currency rates and analysis is crucial for businesses and individuals engaging in international transactions. By staying informed, analyzing market data, and considering relevant macroeconomic factors, one can navigate the complex world of forex currencies more effectively.

Discover more insights and analysis on forex currency rates in the following sections.

Tips

Best PHP to USD Exchange Rates Compared Live - Source www.monito.com

Follow these essential tips to enhance forex trading strategies based on real-time currency exchange rates and in-depth market analysis:

Tip 1: Stay Informed

Continuously monitor economic news, financial reports, and Forex Currency Rates: Real-Time USD Exchange Rates And Analysis to make informed decisions. By keeping abreast of market developments, traders can anticipate potential currency fluctuations and make timely adjustments.

Tip 2: Technical Analysis

Use technical indicators and chart patterns to identify trends, predict price movements, and determine optimal entry and exit points. Technical analysis helps traders make objective decisions based on historical data and market behavior, increasing the probability of success.

Tip 3: Risk Management

Manage risk by implementing stop-loss orders, setting appropriate leverage levels, and diversifying investments. Risk management helps traders minimize potential losses, protect capital, and ensure long-term sustainability in forex trading.

Tip 4: Use Trading Tools

Leverage trading platforms, mobile apps, and other tools to streamline trading processes, monitor market conditions, and execute trades efficiently. Technology can enhance productivity, streamline decision-making, and improve overall trading performance.

Tip 5: Continuous Education

Stay updated on the latest forex trading strategies, market trends, and economic developments. Attend webinars, read industry publications, and seek guidance from experienced traders to continuously improve knowledge and skills. Continuous education empowers traders to adapt to changing market conditions and stay ahead of the curve.

Summary

By incorporating these tips, traders can navigate the dynamic forex market with greater confidence, make informed decisions, and enhance their overall trading strategies. It is important to note that forex trading involves inherent risks, and thorough research and due diligence are crucial for success.

Forex Currency Rates: Real-Time USD Exchange Rates And Analysis

Foreign exchange (forex) currency rates are critical for businesses and individuals involved in international transactions. Live USD exchange rates provide real-time insights into the value of the US dollar against other currencies. Analyzing these rates can help decision-makers navigate the dynamic currency market.

- Current Exchange Rates:

- Historical Trends:

- Economic Indicators:

- Market Sentiment:

- Technical Analysis:

- Currency Pairs:

Abysmal Currency Exchange Rates At Warsaw Airport - Live and Let's Fly - Source liveandletsfly.com

Understanding key aspects of forex currency rates, such as current exchange rates, historical trends, and market sentiment, provides valuable insights. By analyzing these aspects, participants can make informed decisions and mitigate risks associated with currency fluctuations and devise strategies for international business and investment.

Real time foreign exchange rates - picsrilly - Source picsrilly.weebly.com

Forex Currency Rates: Real-Time USD Exchange Rates And Analysis

Forex currency rates, or foreign exchange rates, are the relative values of different currencies in the global market. Real-time USD exchange rates are particularly crucial as the US dollar (USD) remains the world's most traded and widely held currency. These rates have a profound impact on international trade, investment decisions, and global financial markets.

Foreign currency exchange rates - saynic - Source saynic.weebly.com

The analysis of real-time USD exchange rates is essential for businesses involved in global transactions. Fluctuations in exchange rates can significantly affect the profitability of exports and imports, as well as the value of foreign investments. Understanding these rates allows businesses to mitigate risks, optimize foreign exchange strategies, and maximize profits.

For example, a large multinational corporation may have operations in multiple countries and need to transfer funds from one currency to another. By carefully monitoring real-time exchange rates and utilizing tools like currency hedging, the corporation can minimize the impact of exchange rate volatility and ensure a favorable outcome for its financial operations.

In summary, real-time USD exchange rates play a pivotal role in the global financial landscape. Their analysis is indispensable for businesses and investors seeking to navigate international markets effectively. Understanding these rates enables informed decision-making, risk mitigation, and optimization of financial strategies, contributing to sustainable growth and stability in global trade and investment.

Table: Key Factors Influencing Real-Time USD Exchange Rates

| Factor | Description |

|---|---|

| Economic Growth | Strong economic growth indicates higher demand for a country's currency, leading to appreciation. |

| Inflation | High inflation erodes the value of a currency, leading to depreciation. |

| Interest Rates | Higher interest rates attract foreign capital, increasing demand for a currency and causing appreciation. |

| Political Stability | Political instability can erode confidence in a currency, leading to depreciation. |

| Global Economic Conditions | Economic conditions in major trading partners can impact the value of a currency. |