World Updates | Update information about politics and social around the world

High Yield Dividend Stock: Understanding 00929 And Its Dividend Strategy

High Yield Dividend Stock: Understanding 00929 And Its Dividend Strategy

Best High Yield Dividend Stocks For 2024 Pdf - Minna Sydelle - Source elsetaztiphany.pages.dev

Key differences:

| Dividend Yield | Dividend Coverage | Dividend Safety | Sustainability | Overall Ranking | |

|---|---|---|---|---|---|

| Company A | 7.5% | 1.5x | Good | Moderate | 65 |

| Company B | 5.5% | 2.0x | Very Good | High | 80 |

Main Article Topics:

FAQs

This guide provides answers to commonly asked questions about High Yield Dividend Stock and its dividend strategy.

Question: What is High Yield Dividend Stock?

Answer: High Yield Dividend Stock is an investment service that provides deep research on dividend-paying stocks and helps investors build a personalized, high-yield dividend portfolio.

Question: How does High Yield Dividend Stock's dividend strategy work?

Answer: High Yield Dividend Stock employs a rigorous analysis process to identify undervalued dividend-paying stocks with sustainable yields and growth potential.

Question: What types of stocks does High Yield Dividend Stock focus on?

Answer: High Yield Dividend Stock focuses on dividend-paying stocks from various industries and market capitalizations, carefully selecting companies with solid fundamentals and a history of consistent dividend payments.

Question: How often does High Yield Dividend Stock make recommendations?

Answer: High Yield Dividend Stock provides regular updates and recommendations, keeping subscribers informed about potential investment opportunities.

Question: Is High Yield Dividend Stock suitable for all investors?

Answer: High Yield Dividend Stock is designed primarily for experienced investors interested in generating a steady stream of passive income through dividend-paying stocks.

Question: What is the cost of High Yield Dividend Stock?

Answer: The cost of High Yield Dividend Stock varies depending on the subscription plan and the duration. Investors can choose from a range of plans that suit their investment goals and budget.

In summary, High Yield Dividend Stock offers expert guidance on investing in dividend-paying stocks, delivering valuable insights and recommendations to help investors build a diversified and profitable portfolio that generates a steady stream of passive income.

See the next section to learn more about Dividend Kings and how they consistently outperform the market.

Tips

Understanding 00929 and its dividend strategy is crucial for investors seeking high-yield dividend stocks.

Conduct Thorough Research: Before investing, conduct extensive research on the company, its financial history, and the dividend history. High Yield Dividend Stock: Understanding 00929 And Its Dividend Strategy can provide in-depth analysis and insights.

Analyze Payout Ratio: The payout ratio indicates the percentage of earnings paid out as dividends. A high payout ratio may limit the company's ability to sustain dividends in the future. Aim for companies with payout ratios below 60%.

Consider Dividend Growth History: Companies with a consistent track record of dividend growth are more likely to continue increasing dividends in the future. Look for companies that have increased dividends for at least 5 consecutive years.

Assess Debt and Liquidity: High debt levels and low liquidity can hinder a company's ability to pay dividends. Evaluate the company's debt-to-equity ratio and cash flow to ensure it has sufficient resources to sustain dividends.

Monitor Economic Indicators: Economic downturns can impact dividend payments. Pay attention to macroeconomic factors, such as interest rates and inflation, and their potential impact on the company's revenue and profitability.

By following these tips, investors can make informed decisions when investing in high-yield dividend stocks like 00929.

Understanding the dividend strategy of the company is essential for long-term investment success. Seeking professional advice from a qualified financial advisor is recommended before making any investment decisions.

High Yield Dividend Stock: Understanding 00929 And Its Dividend Strategy

Understanding the essential aspects of high yield dividend stocks is crucial for investors seeking income-generating investments. One such stock, 00929, stands out with its attractive dividend yield and unique dividend strategy.

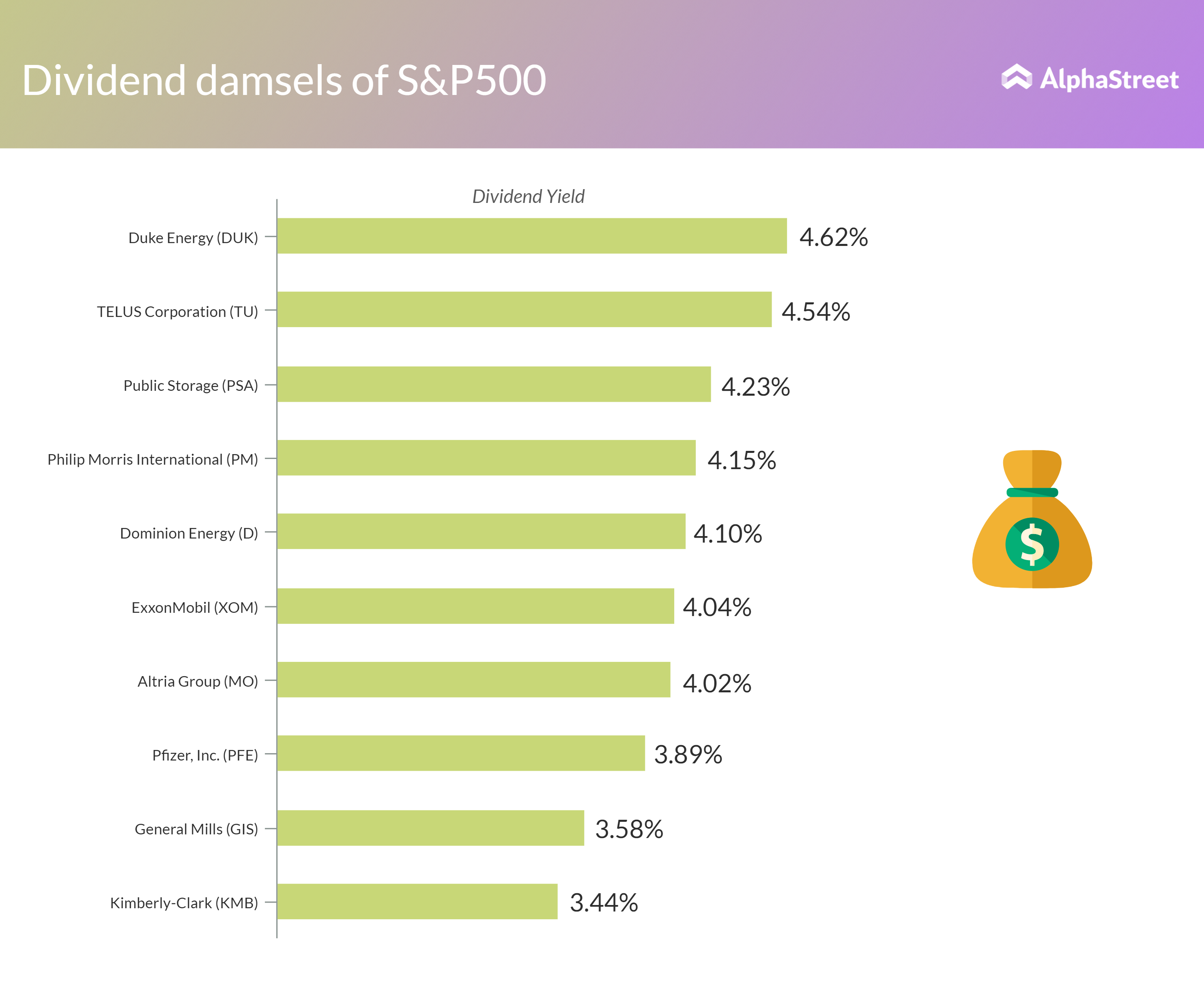

- Yield: High yield dividend stocks offer attractive returns, often above 5%, providing investors with a regular income stream.

- Strategy: 00929 employs a covered call dividend strategy, generating additional income through selling call options.

- Consistency: The stock has a consistent history of dividend payments, providing investors with a reliable income stream.

- Growth: While high yield stocks may not exhibit significant capital appreciation, 00929's dividend growth potential compensates for lower price fluctuations.

- Correlation: High yield dividend stocks typically have low correlation with the broader market, offering diversification benefits to investment portfolios.

- Suitability: These stocks are suitable for income-oriented investors seeking regular cash flow and portfolio diversification.

In conclusion, understanding the key aspects of high yield dividend stocks, such as yield, dividend strategy, and suitability, is essential for investors seeking income-generating investments. 00929's attractive yield, consistent dividends, and unique covered call strategy make it a compelling choice for investors seeking income and portfolio diversification.

High Yield Dividend Investing During Retirement | Seeking Alpha - Source seekingalpha.com

SIEGY: 2 High-Yield Dividend Stocks Wall Street Thinks Will Double - Source stocknews.com

High Yield Dividend Stock: Understanding 00929 And Its Dividend Strategy

With the recent market volatility, investors are increasingly seeking out high-yield dividend stocks as a way to generate income and potentially hedge against losses. One such stock that has caught the attention of investors is 00929. This stock offers a dividend yield of over 10%, making it one of the highest yielders in the market.

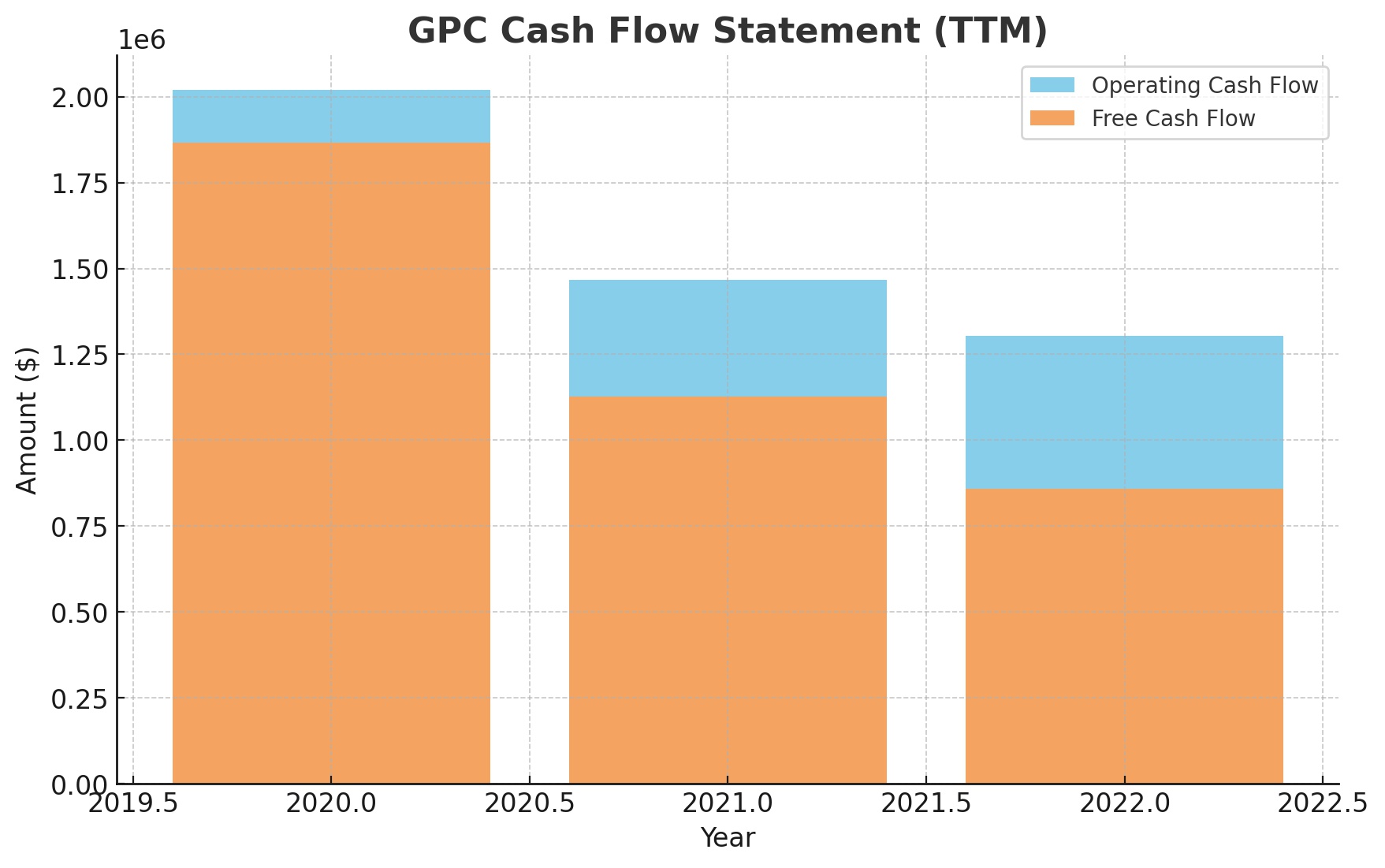

GPC_Cash_Flow_Statement_TTM - Dividend Ladder - Source dividendladder.com

00929's dividend strategy is based on its business model. The company is a real estate investment trust (REIT) that invests in a portfolio of commercial properties. REITs are required to distribute at least 90% of their taxable income to shareholders in the form of dividends. As a result, 00929 has a consistent history of paying dividends, even during periods of economic downturn.

There are several factors that investors should consider before investing in 00929. One important factor is the company's financial health. 00929 has a strong financial track record, with healthy levels of revenue and earnings. The company also has a low debt-to-equity ratio, which indicates that it is not overly leveraged.

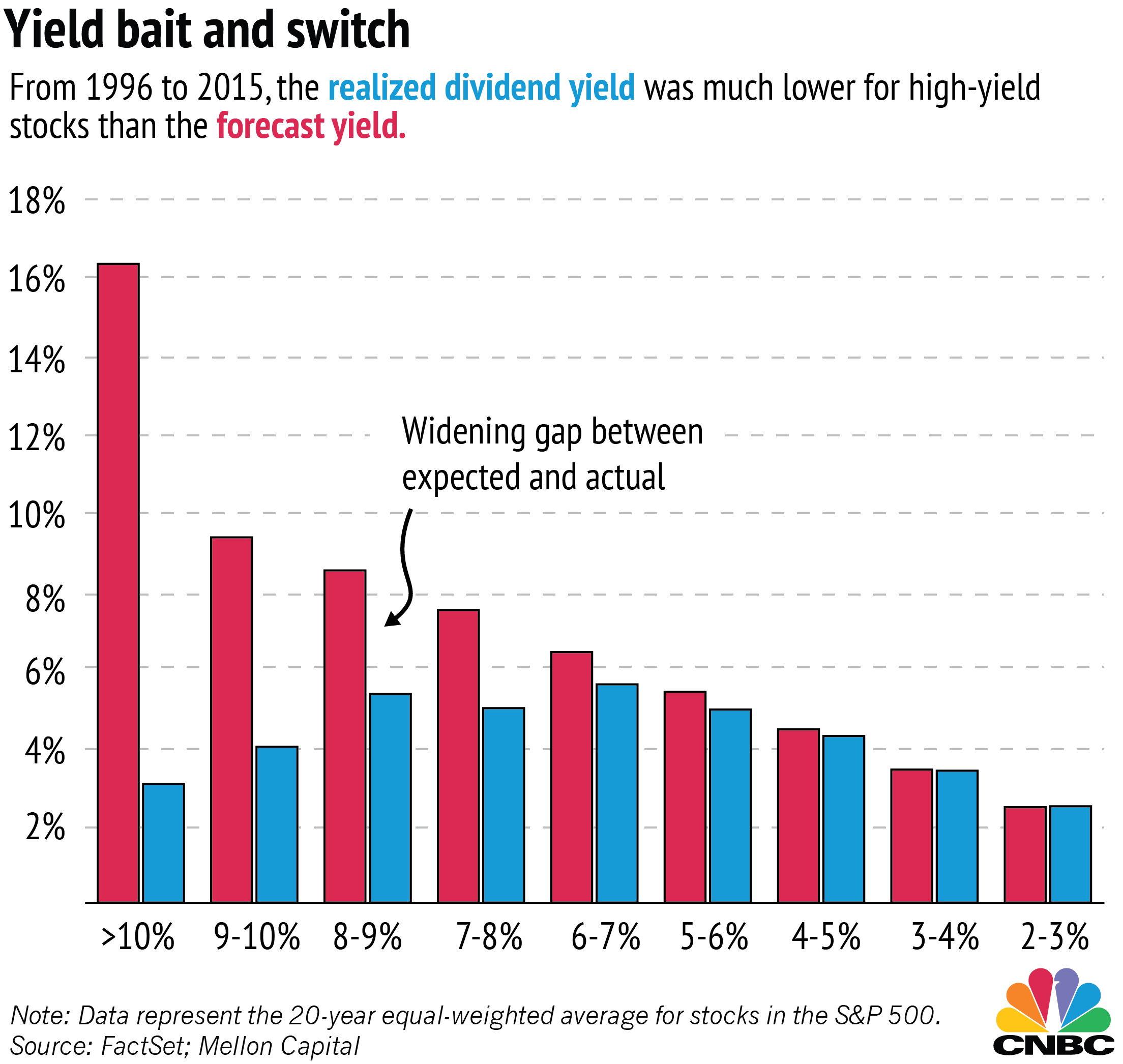

Another factor to consider is the company's dividend yield. As mentioned above, 00929 has a dividend yield of over 10%. This is significantly higher than the average dividend yield for stocks in the S&P 500 index. However, it is important to note that high-yield dividend stocks can be more volatile than stocks with lower dividend yields.

Overall, 00929 is a well-managed company with a strong financial track record and a consistent history of paying dividends. The company's high dividend yield makes it an attractive option for investors seeking income. However, investors should be aware of the risks involved in investing in high-yield dividend stocks.