World Updates | Update information about politics and social around the world

Mutual Insurance Returns From The Treasury: A Comprehensive Guide For Taxpayers

Have you heard of "Mutual Insurance Returns From The Treasury: A Comprehensive Guide For Taxpayers"?

Editor's Note: "Mutual Insurance Returns From The Treasury: A Comprehensive Guide For Taxpayers" was published on [date]. This topic is a must-read, especially for taxpayers.

We understand that tax season can be a stressful time, which is why we've taken the time to analyze, dig into the information, and put together this comprehensive guide. Our goal is to help you make well-informed decisions when it comes to your mutual insurance returns and maximize your tax savings.

Key Differences

| Feature | Mutual Insurance Returns | Regular Insurance Returns |

|---|---|---|

| Tax Treatment | Tax-free | Taxable |

| Investment Earnings | Not subject to income tax | Subject to income tax |

| Eligibility | Only available to members of mutual insurance companies | Available to all taxpayers |

Main Article Topics

- Understanding Mutual Insurance Returns

- Qualifying for Mutual Insurance Returns

- Calculating Your Mutual Insurance Return

- Filing Your Mutual Insurance Return

- Common Mistakes to Avoid

FAQs

This guide provides a comprehensive understanding of mutual insurance returns from the treasury for taxpayers. To clarify any lingering uncertainties, we present answers to commonly asked questions.

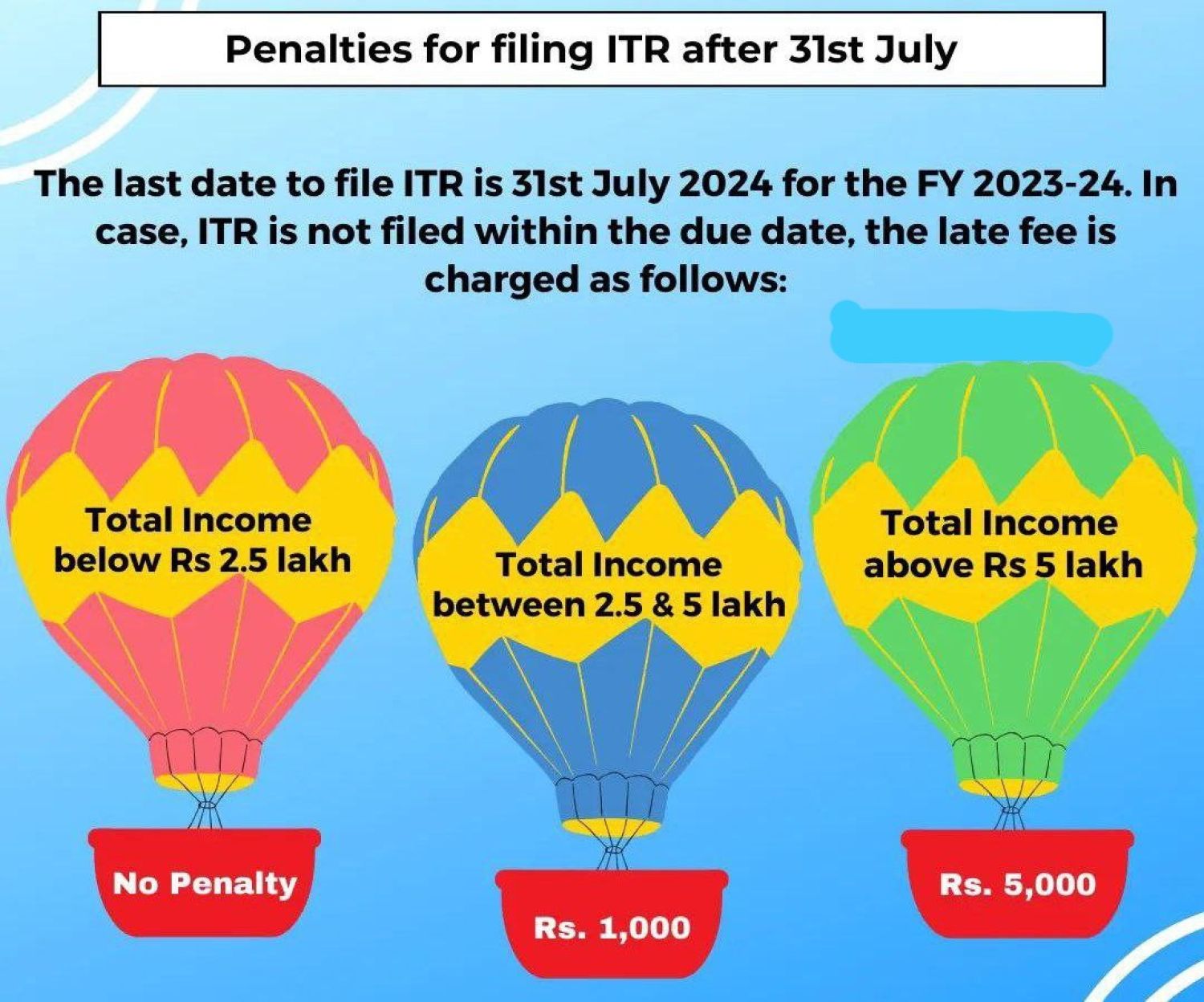

filing ITR Returns for the FY 2023-2024, - Source carajput.com

Question 1: What are mutual insurance returns?

Mutual insurance returns are dividends or other distributions made by a mutual insurance company to its policyholders. These returns represent a portion of the excess premiums paid by policyholders, which the company returns after accounting for expenses and reserves.

Question 2: How are mutual insurance returns taxed?

Mutual insurance returns are generally treated as dividend income for tax purposes. They are typically eligible for the dividend-received deduction, which allows taxpayers to exclude a portion of the dividend income from taxation.

Question 3: Do all mutual insurance companies pay returns?

No, not all mutual insurance companies pay returns. Mutual insurance companies are not obligated to distribute returns to policyholders, and the amount of returns paid varies depending on factors such as the company's financial performance and its policy guidelines.

Question 4: How can I claim mutual insurance returns on my tax return?

Taxpayers who receive mutual insurance returns should report the amount on Schedule B (Form 1040) or Schedule C (Form 1040) if self-employed. The reporting requirements may vary depending on the type of return received, such as cash, stock, or property.

Question 5: Are mutual insurance returns subject to capital gains tax?

Mutual insurance returns are generally not subject to capital gains tax unless the returns are received in the form of appreciated property or stock. In such cases, the appreciation in value may be taxed as capital gains.

Question 6: What are the key takeaways regarding mutual insurance returns?

Mutual insurance returns provide a potential return on premiums paid and are typically taxed as dividend income. Taxpayers should consult their tax preparer or tax professional for specific guidance based on their individual circumstances.

Explore other sections of this guide for a deeper understanding of mutual insurance returns and their tax implications.

Tips

This Mutual Insurance Returns From The Treasury: A Comprehensive Guide For Taxpayers article provides useful tips for taxpayers to maximize their mutual insurance returns from the Treasury.

Tip 1: File on time.

Filing your mutual insurance return on time is crucial to avoid penalties and interest charges. The due date for filing your return is typically April 15th, but it can vary depending on your specific situation. If you are unable to file your return on time, you can request an extension.

Tip 2: Keep accurate records.

Keeping accurate records of your mutual insurance premiums and distributions is essential for preparing an accurate tax return. You can use a spreadsheet or other software to track this information. Having organized records will make it easier to claim the correct deductions and credits on your return.

Tip 3: Understand the tax implications of mutual insurance distributions.

Mutual insurance distributions are generally taxable as ordinary income. However, there are some exceptions to this rule. For example, distributions that are used to purchase additional mutual insurance coverage are not taxable. It is important to understand the tax implications of mutual insurance distributions to avoid paying more taxes than necessary.

Tip 4: Consider using a tax professional.

If you have a complex mutual insurance situation, you may want to consider using a tax professional to prepare your return. A tax professional can help you to understand the tax implications of your mutual insurance distributions and can ensure that you are claiming all of the deductions and credits that you are entitled to.

Tip 5: File electronically.

Filing your mutual insurance return electronically is the fastest and most accurate way to file. You can file electronically using the IRS website or through a tax software program. Filing electronically can help you to avoid errors and can speed up the processing of your return.

Summary of key takeaways or benefits:

By following these tips, you can maximize your mutual insurance returns from the Treasury. Filing on time, keeping accurate records, understanding the tax implications of mutual insurance distributions, and filing electronically can all help you to get the most out of your mutual insurance policy.

Transition to the article's conclusion:

For more information on mutual insurance returns from the Treasury, please refer to the Mutual Insurance Returns From The Treasury: A Comprehensive Guide For Taxpayers.

Mutual Insurance Returns From The Treasury: A Comprehensive Guide For Taxpayers

This comprehensive guide aims to provide taxpayers with a thorough understanding of mutual insurance returns from the treasury, encompassing six key aspects that delve into various dimensions of this topic.

- Eligibility Requirements: Criteria determining who qualifies for such returns.

- Types of Eligible Entities: Identifying the categories of entities covered by these returns.

- Deductibility of Contributions: Exploring the tax implications of contributions made to mutual insurance companies.

- Reporting Obligations: Outlining the responsibilities of taxpayers in reporting these returns.

- Tax Exemptions: Highlighting the circumstances under which these returns may be exempt from taxation.

- Compliance Considerations: Emphasizing the importance of adhering to established regulations.

Dispute Resolution Scheme For Small & Medium Taxpayers A Comprehensive - Source mandjservice.com

A thorough grasp of these aspects is crucial for taxpayers to optimize their returns and navigate the intricate tax landscape associated with mutual insurance companies. Understanding eligibility requirements ensures that individuals and organizations can accurately determine their qualification status. Recognizing the different types of eligible entities helps taxpayers identify the specific provisions that apply to them. Furthermore, comprehending the deductibility of contributions enables taxpayers to plan their financial strategies effectively. Reporting obligations and tax exemptions provide clarity on the responsibilities and potential benefits associated with these returns. Lastly, compliance considerations underscore the significance of adhering to established regulations to avoid penalties or legal complications.

57 Income and Expenses to be reported in New AIS: A Comprehensive Guide - Source www.krishnakumawat.com

Mutual Insurance Returns From The Treasury: A Comprehensive Guide For Taxpayers

Mutual insurance returns from the treasury are a vital component of the tax landscape. Understanding this topic provides taxpayers with the knowledge to navigate the intricacies of the tax system and maximize their returns. This guide explores the connection between mutual insurance returns from the treasury and their significance for taxpayers, examining real-life examples to illustrate their practical implications.

.jpg)

Treasury ‘preventing’ NHS from maximising taxpayers’ money | The - Source www.independent.co.uk

Mutual insurance companies operate on a not-for-profit basis, returning any surplus funds to their policyholders as dividends. These dividends are considered a return of premium and are, therefore, not subject to income tax. However, they may be subject to other taxes, such as the Medicare surtax. Understanding the tax implications of these returns is crucial for accurate tax filing.

For example, a taxpayer who receives a mutual insurance dividend of $5,000 may not have to pay income tax on it. However, if they are subject to the Medicare surtax, they may be liable for a 3.8% tax on the dividend. Consulting with a tax professional can help taxpayers determine their specific tax obligations.

In conclusion, mutual insurance returns from the treasury are a valuable consideration for taxpayers. By understanding the tax implications of these returns, taxpayers can maximize their returns and minimize their tax liability. This guide provides a comprehensive overview of this topic, enabling taxpayers to make informed decisions about their tax planning.