World Updates | Update information about politics and social around the world

Nestlé: A Long-Term Investment Opportunity In The Food And Beverage Sector

Nestlé: A Long-Term Investment Opportunity In The Food And Beverage Sector?

Editor's Notes: "Nestlé: A Long-Term Investment Opportunity In The Food And Beverage Sector" have published today date. Nestlé: A Long-Term Investment Opportunity In The Food And Beverage Sector topic is important for long term prospective and current investors in the food and beverage industry.

After analyzing and digging through numerous qualitative and quantitative data sources, we have put together this guide to help prospective and current investors make the right decision.

| Nestlé | Food and Beverage Industry | |

|---|---|---|

| Revenue | CHF 94.4 billion in 2022 | $1.75 trillion in 2023 (estimated) |

| Net income | CHF 14.2 billion in 2022 | $122.2 billion in 2023 (estimated) |

| Market capitalization | CHF 377 billion as of August 2023 | $15 trillion as of August 2023 |

| Dividend yield | 2.4% as of August 2023 | 3.1% as of August 2023 |

As can be seen from the table above, Nestlé is a dominant player in the food and beverage industry, with a market capitalization that is more than twice the size of the next largest company in the industry. Nestlé's strong financial performance is underpinned by its diverse product portfolio, which includes well-known brands such as Nescafé, KitKat, and Maggi. The company also has a strong track record of innovation, which has helped it to stay ahead of the competition.

FAQ

This FAQ section provides answers to frequently asked questions about Nestlé, a global food and beverage company. These questions address common concerns and misconceptions, offering insights into the company's financial performance, long-term strategy, and sustainability practices.

Question 1: Is Nestlé a good long-term investment?

Yes, Nestlé has consistently demonstrated financial resilience and growth over the long term. The company's diversified portfolio of products and brands, strong global presence, and commitment to innovation have enabled it to navigate economic downturns and industry challenges. Its track record of dividend payments and share price appreciation further supports its status as a reliable investment option.

UAE's Food & Beverage Sector Open for Investment - Source thefinanceworld.com

Question 2: What is Nestlé's long-term strategy?

Nestlé's long-term strategy focuses on three key pillars: organic growth, strategic acquisitions, and operational efficiency. The company aims to drive organic growth through innovation, product differentiation, and expansion into emerging markets. It also pursues strategic acquisitions to complement its existing portfolio and gain access to new technologies or capabilities. Additionally, Nestlé continuously seeks ways to improve its operational efficiency, optimize its supply chain, and reduce costs.

Question 3: Is Nestlé committed to sustainability?

Yes, Nestlé recognizes the importance of sustainability and has made significant commitments in this area. The company has set ambitious goals for reducing its environmental impact, sourcing its ingredients responsibly, and promoting healthier and more sustainable diets. Nestlé's sustainability initiatives include reducing greenhouse gas emissions, eliminating plastic waste, and supporting sustainable agriculture practices.

Question 4: What are some of Nestlé's key financial metrics?

Nestlé's key financial metrics include strong revenue growth, expanding profit margins, and consistent dividend payments. The company's revenue has grown steadily over the years, supported by its diverse product portfolio and global presence. Nestlé also maintains healthy profit margins, reflecting its efficient operations and pricing power. The company has a long history of paying dividends to shareholders, further enhancing its appeal as a long-term investment.

Question 5: How does Nestlé compare to its competitors?

Nestlé is a global industry leader in the food and beverage sector. Compared to its competitors, Nestlé boasts a larger market share, a broader product portfolio, and a stronger distribution network. The company's scale and diversification allow it to compete effectively and maintain a competitive edge.

Question 6: What are the potential risks associated with investing in Nestlé?

Like any investment, investing in Nestlé carries certain risks. These risks include economic downturns, changes in consumer preferences, regulatory challenges, supply chain disruptions, and currency fluctuations. However, Nestlé's long-term track record, diversified portfolio, and strong financial position help mitigate these risks and provide investors with a solid investment opportunity.

In summary, Nestlé presents a compelling investment opportunity in the food and beverage sector. The company's long-term growth prospects, commitment to sustainability, and strong financial performance make it a reliable and potentially rewarding investment choice.

Disclaimer: This FAQ section is for informational purposes only and should not be construed as investment advice. Investors should conduct their own research and consult with a financial advisor before making any investment decisions.

Tips

If you are looking for a long-term investment in the food and beverage sector, Nestlé: A Long-Term Investment Opportunity In The Food And Beverage Sector is a company that should be on your radar.

Tip 1: Strong Brand Portfolio

Nestlé owns a portfolio of iconic brands, including KitKat, Nescafé, and Maggi. These brands are well-recognized and trusted by consumers worldwide, which gives Nestlé a competitive advantage in the market.

Tip 2: Diversified Product Line

Nestlé's product line includes a wide range of food and beverage products, from baby food to pet food. This diversification helps to reduce the company's risk exposure and provides opportunities for growth in different market segments.

Tip 3: Global Reach

Nestlé has a global presence, with operations in over 180 countries. This gives the company access to a vast and diverse customer base, which supports its long-term growth prospects.

Tip 4: Innovation and R&D

Nestlé invests heavily in innovation and research and development, which allows it to stay at the forefront of the industry. The company's commitment to innovation has led to the development of new products and technologies, which have contributed to its success.

Tip 5: Strong Financial Performance

Nestlé has a track record of strong financial performance, with consistent revenue and earnings growth. The company's financial stability and profitability make it an attractive investment for long-term investors.

Key Takeaways:

- Nestlé is a well-established company with a strong brand portfolio and diversified product line.

- The company has a global reach and is committed to innovation and R&D.

- Nestlé has a strong financial performance and is a stable investment.

In conclusion, Nestlé is a company with a long history of success and a strong position in the food and beverage sector. Its strong brand portfolio, diversified product line, global reach, commitment to innovation, and strong financial performance make it a compelling long-term investment opportunity.

Nestlé: A Long-Term Investment Opportunity In The Food And Beverage Sector

Nestlé, a global leader in the food and beverage industry, presents compelling reasons for long-term investment consideration. Its strengths lie in key aspects that drive its success and resilience.

- Global Reach: Operating in over 190 countries, Nestlé benefits from a vast and diverse consumer base.

- Diverse Portfolio: With a wide range of products, including coffee, dairy, confectionery, and pet care, Nestlé caters to various consumer needs.

- Strong Brands: Nestlé owns some of the most iconic brands in the world, such as Nescafé, KitKat, and Maggi, providing strong brand recognition and loyalty.

- Innovation Driven: Nestlé invests heavily in research and development, leading to a pipeline of innovative products that meet evolving consumer demands.

- Sustainability Focus: Nestlé's commitment to sustainability enhances its long-term viability and aligns with consumer preferences.

- Dividend Track Record: Nestlé has a consistent track record of dividend payments, indicating its ability to generate cash flow and reward shareholders.

These factors, combined with Nestlé's financial strength, operational excellence, and commitment to innovation, reinforce its position as a compelling long-term investment opportunity in the food and beverage sector. Its global reach, diverse portfolio, and strong brands provide a solid foundation for sustained growth, while its innovation drive and sustainability focus ensure long-term relevance and resilience.

Forging their own path to growth: Agriculture, Food & Beverage sector - Source www.hlbgravier.com

Nestlé: A Long-Term Investment Opportunity In The Food And Beverage Sector

Nestlé, the world's largest food and beverage company, offers a compelling long-term investment opportunity due to its combination of industry leadership, global scale, and consistent growth trajectory. Its diverse portfolio, strong brand recognition, and focus on sustainable practices make it an attractive investment for those seeking stable returns and exposure to the growing food and beverage sector.

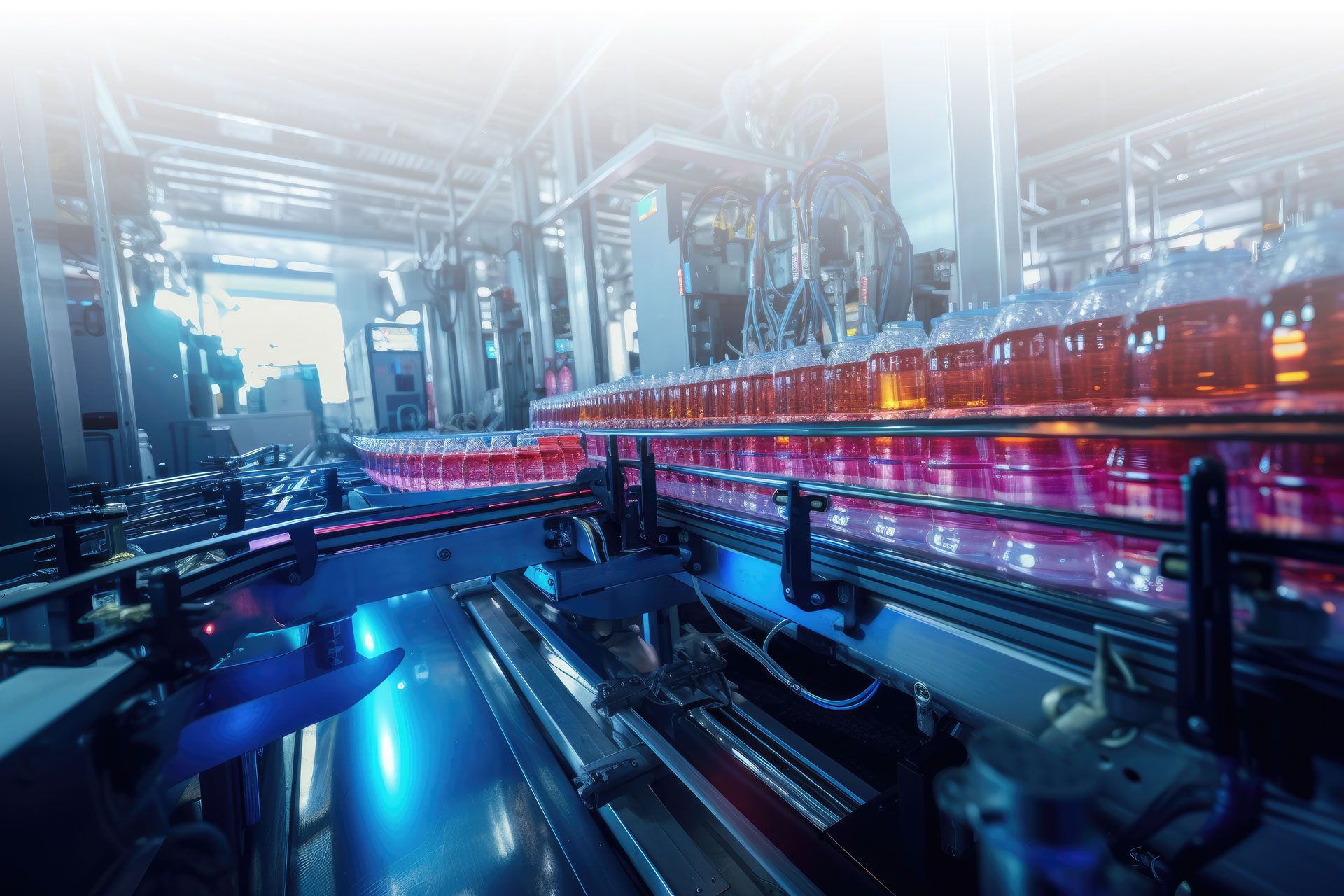

Food & Beverage Water Treatment | Ovivo Industrial - Source industrial.ovivowater.com

Nestlé's industry leadership and global reach, which include substantial market share in key categories such as coffee, confectionery, and dairy, provide it with significant competitive advantages. The company's diverse portfolio, which encompasses over 2000 products sold in more than 190 countries, allows it to cater to a wide range of consumer needs and dietary preferences. Additionally, Nestlé's long-standing brand recognition and customer loyalty, particularly among trusted brands like Nescafé, KitKat, and Maggi, enhance its pricing power and competitive edge.

Nestlé's commitment to sustainable practices and responsible sourcing further strengthens its investment case. The company's initiatives in environmental stewardship, social responsibility, and ethical sourcing align with growing consumer demand for products that are produced responsibly. This commitment not only enhances Nestlé's reputation but also positions it as a leader in the sustainable food and beverage sector.

Investors seeking long-term growth and stability should consider Nestlé as a potential investment opportunity. Its industry leadership, global reach, diverse portfolio, strong brand recognition, and focus on sustainability provide a solid foundation for long-term returns.

Conclusion

Nestlé's position as a long-term investment opportunity in the food and beverage sector is supported by its industry leadership, global scale, diverse portfolio, strong brands, and commitment to sustainability. Investors looking for stable returns, exposure to the growing food and beverage sector, and alignment with responsible investment practices should consider Nestlé as a potential investment.

As consumer demand for sustainable, healthy, and convenient food and beverage products continues to grow, Nestlé's commitment to these areas will likely continue to drive its long-term success and make it an attractive investment opportunity for years to come.