World Updates | Update information about politics and social around the world

Pensions For January 2025: Essential Updates And Impact Analysis

Pensions For January 2025: Essential Updates And Impact Analysis A guide to the latest changes and their potential impact on your retirement planning.

Editor's Note: This Pensions For January 2025: Essential Updates And Impact Analysis was published on [Insert Date] and is intended to help you make informed decisions about your retirement planning.

Our team of experts have spent countless hours analyzing the data and gathering information to give you the most up-to-date and accurate information possible. We've put together this guide to help you understand the changes that are coming and how they will affect your retirement plans.

| Key Difference | | Key Takeaways | |

|---|---|---|---|

| Pension Age | | The State Pension age for both men and women will increase to 67 | |

| Pension Contributions | | The amount you can contribute to your pension will increase | |

| Pension Tax Relief | | The amount of tax relief you can claim on your pension contributions will change | |

The changes to pensions in January 2025 are significant and will have a major impact on how you plan for your retirement. It is important to understand these changes and how they will affect you so that you can make the right decisions about your retirement planning.

FAQ

This section provides essential FAQs regarding the upcoming pension adjustments in January 2025, addressing common queries and potential impacts on individuals and organizations.

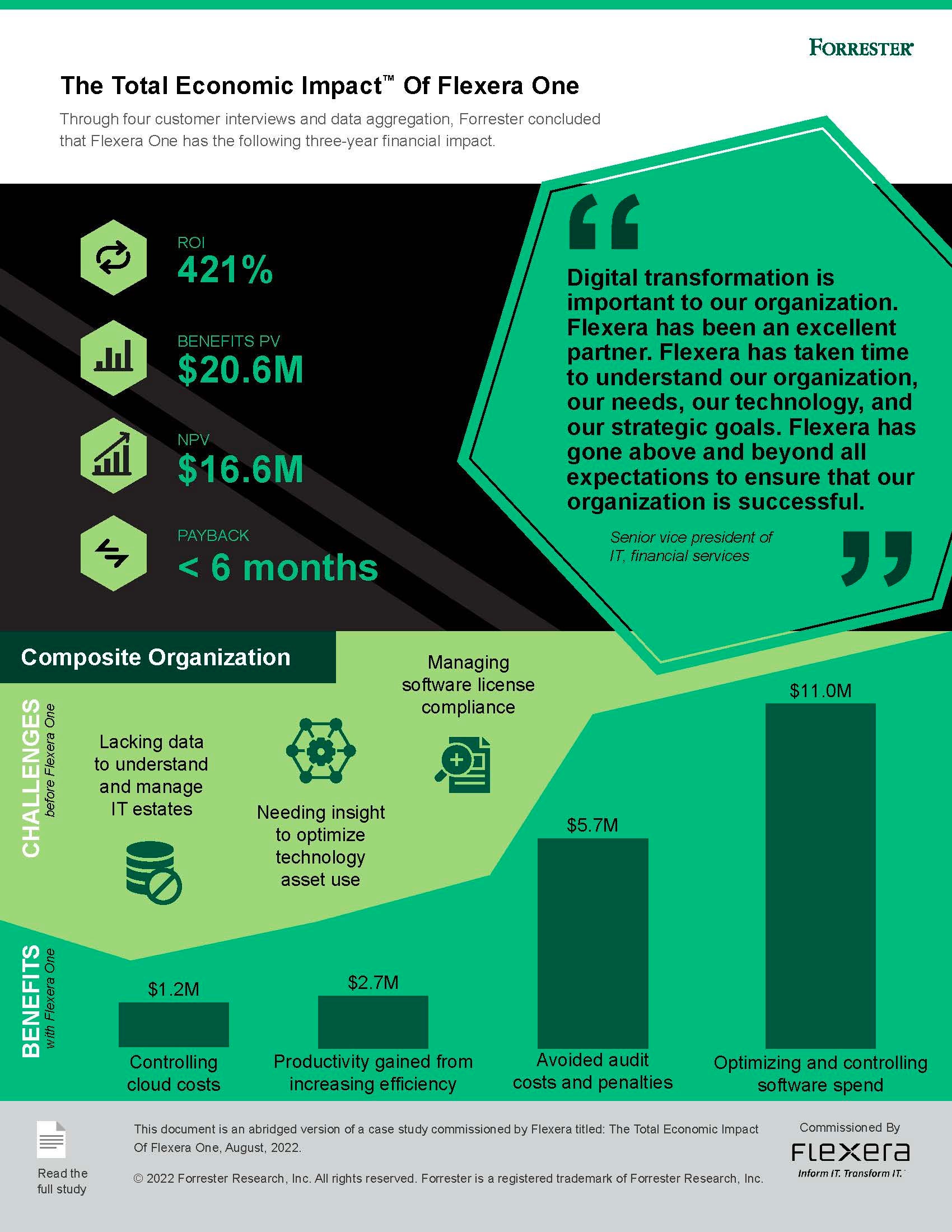

Economic Impact Relief 2025 - Boris Hemmings - Source borishemmings.pages.dev

Question 1: What are the key changes to pensions in January 2025?

The primary change is an increase in the State Pension age for both men and women, aligning it at 68 years old. Additionally, there will be adjustments to the earnings threshold for National Insurance contributions, affecting the amount of pension entitlement for some individuals.

Question 2: How will the increase in State Pension age impact individuals?

Those approaching retirement age in January 2025 will need to work longer to qualify for the State Pension. This may have implications for financial planning and retirement goals, and individuals should consider adjusting their pension contributions accordingly.

Question 3: What are the implications for employers?

Employers may need to review their pension schemes and assess the potential impact on their workforce. The increase in State Pension age could lead to employees working beyond the traditional retirement age, impacting workforce planning and pension costs.

Question 4: Are there any exceptions to the new State Pension age?

Certain individuals may be exempt from the increase in State Pension age due to specific circumstances, such as having a qualifying disability or caring responsibilities. It is recommended to seek professional guidance to determine eligibility for exemptions.

Question 5: What should individuals do to prepare for the pension changes?

Individuals should review their retirement plans and consider seeking financial advice to optimize their pension contributions. They may also need to adjust their savings and investment strategies to ensure a sufficient income stream during retirement.

Question 6: Where can I find more information and support?

The government provides comprehensive information on the pension changes on its website. Individuals can also contact the Department for Work and Pensions (DWP) or seek guidance from a qualified financial advisor for personalized advice.

It is crucial to note that this FAQ section only provides a general overview of the pension changes in January 2025. Individuals are advised to consult official sources and seek professional advice for specific circumstances and guidance.

Next: Impact Analysis of Pension Changes

Tips by Pensions For January 2025: Essential Updates And Impact Analysis

The rollout of the new state pension in 2016 was a major reform of the UK pension system. The new system is more complex than the old one, and there are a number of things that people need to be aware of in order to make sure they are getting the most out of their pension. The following tips will help you to understand the new state pension and how it will affect you.

Tip 1: Find out your state pension age

The state pension age is the age at which you can start drawing your state pension. The state pension age is gradually increasing, and it will reach 68 for both men and women by 2046. You can find out your state pension age by visiting the government website.

Tip 2: Check your National Insurance record

Your National Insurance record shows how many qualifying years you have towards the state pension. You need at least 10 qualifying years to be entitled to any state pension, and you need 35 qualifying years to get the full amount. You can check your National Insurance record online or by contacting the Department for Work and Pensions.

Tip 3: Make sure you are paying enough National Insurance contributions

If you are not paying enough National Insurance contributions, you may not have enough qualifying years to get the state pension, or you may get a lower amount of pension. You can make voluntary National Insurance contributions if you are not paying enough through your work.

Tip 4: Consider increasing your state pension

There are a number of ways to increase your state pension. You can do this by paying voluntary National Insurance contributions, working part-time or at a lower salary, or deferring your state pension.

Tip 5: Get advice from a financial adviser

If you are not sure how the new state pension will affect you, you should get advice from a financial adviser. They can help you to understand your options and make the best decisions for your retirement.

By following these tips, you can make sure that you are getting the most out of your state pension. The state pension is a valuable source of income in retirement, and it is important to make sure that you are maximizing your entitlement.

Pensions For January 2025: Essential Updates And Impact Analysis

This article aims to elucidate the critical dimensions of the upcoming pension updates in January 2025, their implications, and key factors to consider.

- Eligibility Expansion: Extending pension coverage to a broader range of individuals.

- Contribution Adjustments: Modifying contribution rates or regulations to enhance pension system sustainability.

- Benefit Enhancements: Potential increases to pension payouts or expanded eligibility for certain benefits.

- Investment Strategies: Reassessing and adjusting investment strategies to optimize returns within risk tolerance.

- Tax Implications: Analyzing the impact of potential tax changes on pension contributions and distributions.

- Demographic Shifts: Considering the impact of aging demographics and workforce participation trends on pension funding.

These key aspects interweave to shape the future of pensions. Contribution adjustments may impact individuals' current and future financial planning. Benefit enhancements can provide financial security in retirement but must be balanced with system sustainability. Investment strategies play a crucial role in ensuring pension funds' long-term viability. The article underscores the importance of staying informed about these updates and seeking professional guidance to navigate the complexities and potential implications for individuals and the pension system as a whole.

Cute January 2025 Printable Calendar Free - Alma Lyndel - Source harrietwajay.pages.dev

Pensions for January 2025: Essential Updates and Impact Analysis

In January 2025, significant updates to the pension system will come into effect. These changes are intended to ensure the sustainability of the pension system and to provide greater flexibility for retirees. The updates include changes to the State Pension age, the introduction of a new single-tier pension, and changes to the way that pensions are calculated.

January 2025 Calendar With Festivals - Editable Calendar Planner 2025 - Source feb2025festivalcalendar.pages.dev

The State Pension age is the age at which people can start to receive their State Pension. The State Pension age is currently 66 for both men and women, but it is set to increase to 67 for both men and women in 2028. This means that people who are currently in their 50s or 60s will need to work for longer before they can start to receive their State Pension.

The new single-tier pension will replace the current two-tier pension system. The two-tier pension system consists of a basic State Pension and a second-tier pension, which is based on earnings. The new single-tier pension will be based on earnings and will provide a higher level of pension for low earners. The changes to the way that pensions are calculated will affect the amount of pension that people receive. The current system of calculating pensions is based on the best 35 years of earnings. The new system will be based on the average of all earnings over a person's working life.

The updates to the pension system will have a significant impact on people's retirement plans. It is important for people to understand the changes and to make sure that they are prepared for them.

| Change | Impact |

|---|---|

| Increase in State Pension age | People will need to work for longer before they can receive their State Pension. |

| Introduction of a new single-tier pension | This will provide a higher level of pension for low earners. |

| Changes to the way that pensions are calculated | This will affect the amount of pension that people receive. |

Conclusion

The changes to the pension system in January 2025 are significant and will have a major impact on people's retirement plans. It is important to understand the changes and to make sure that you are prepared for them.

There are a number of things that you can do to prepare for the changes. You can start by checking your State Pension forecast to see how much State Pension you are likely to receive. You can also start saving for your retirement, either through a personal pension or a workplace pension.

The changes to the pension system are designed to ensure the sustainability of the system and to provide greater flexibility for retirees. However, it is important to be aware of the changes and to make sure that you are prepared for them.