World Updates | Update information about politics and social around the world

Tabla De Pensiones 2024: Calcula Tu Pensión De Jubilación Y Descubre Los Nuevos Cambios

Do You Know How to Calculate your Retirement Pension? Discover The "Tabla De Pensiones 2024: Calcula Tu Pensión De Jubilación Y Descubre Los Nuevos Cambios"

Solicitudde Pension - INSTITUTO MEXICANO DEL SEGURO SOCIAL FORMA IMSS - Source www.studocu.com

Editor's Note: "Tabla De Pensiones 2024: Calcula Tu Pensión De Jubilación Y Descubre Los Nuevos Cambios" was just published today from the official website of the organization. With the introduction of the new pension contribution system in 2024, as it is crucial that you understand how to calculate your retirement pension and plan accordingly. To help you understand these changes, let's dive into the details of the "Tabla De Pensiones 2024: Calcula Tu Pensión De Jubilación Y Descubre Los Nuevos Cambios" and uncover the benefits it offers.

Our team has done extensive research, digging deep into the information provided in the "Tabla De Pensiones 2024: Calcula Tu Pensión De Jubilación Y Descubre Los Nuevos Cambios" and put together this comprehensive guide. Our goal is to empower you with the knowledge you need to make an informed decision about your retirement planning.

Key Differences and Takeaways:

Transition to Main Article Topics:

FAQs: 2024 Pension Tables and Retirement Pension Calculation

The 2024 pension tables are now available, allowing individuals to calculate their estimated retirement pension. This article provides answers to some frequently asked questions about the new pension tables and changes.

LA PENSIÓN DE JUBILACIÓN DE LOS FUNCIONARIOS DE CLASES PASIVAS: RESUMEN - Source laboralpensiones.com

Question 1: What are the key changes in the 2024 pension tables?

The 2024 pension tables introduce several changes, including an increase in the state pension age, changes to the calculation of pension entitlement, and a new flat-rate pension for those reaching state pension age after April 2016.

Question 2: How can I calculate my estimated retirement pension?

To calculate your estimated retirement pension, you can use the online pension calculator provided by the Department for Work and Pensions (DWP). The calculator requires information such as your date of birth, National Insurance record, and any additional pension contributions.

Question 3: What if I am not happy with my estimated pension?

If you are not satisfied with your estimated pension, several options are available to you. You can consider increasing your National Insurance contributions, making additional voluntary contributions to a pension scheme, or seeking financial advice.

Question 4: How can I get help with pension planning?

There are numerous resources available to help you with pension planning. You can contact the DWP, visit a Citizens Advice bureau, or speak to a financial advisor.

Question 5: What are the tax implications of drawing a pension?

When you draw a pension, a portion of it may be subject to income tax. The amount of tax you pay will depend on your personal circumstances, including your income and the type of pension you have.

Question 6: What should I do next?

Once you have calculated your estimated retirement pension and considered your options, it is essential to review your pension arrangements regularly. This will help you ensure that you are on track to achieve your retirement goals.

Stay updated on the latest pension news and developments by subscribing to our newsletter or visiting the DWP website.

Tips

The 2024 Pension Table offers a comprehensive calculation of pension benefits at retirement, incorporating recent changes and regulations. Here are a few tips to guide individuals in optimizing their pension plans:

Tip 1: Determine eligibility for state pension.

Individuals must meet specific age and National Insurance contribution requirements to qualify for the state pension. Checking eligibility status provides a solid foundation for further pension planning.

Tip 2: Calculate potential pension income.

Utilizing the Pension Table, individuals can estimate their future pension income based on their current contributions and expected retirement age. This helps in setting realistic expectations and making informed decisions.

Tip 3: Consider additional pension options.

Private pensions, stakeholder pensions, and self-employed pensions may complement the state pension. Exploring these options can enhance overall retirement income and provide financial security in later years.

Tip 4: Maximize employer contributions.

Many employers offer workplace pension schemes with matching contributions. Taking full advantage of these schemes ensures higher pension savings and a more secure retirement.

Tip 5: Review pension projections regularly.

Annual pension statements provide updates on projected pension income. Regularly reviewing these statements allows individuals to track progress and make necessary adjustments to their retirement plans.

Tip 6: Seek professional advice.

For complex pension situations, consulting a financial advisor is recommended. They can provide personalized guidance, considering individual circumstances and goals, to optimize pension outcomes.

Tip 7: Understand the impact of changes.

Pension regulations are subject to periodic changes. Staying informed about these changes helps individuals adapt their plans accordingly and ensure they benefit from the latest provisions.

Tip 8: Plan for a comfortable retirement.

Early retirement planning allows individuals to accumulate sufficient pension savings and explore additional income-generating options. This proactive approach ensures financial independence and a comfortable retirement lifestyle.

For further details and comprehensive pension calculations, refer to Tabla De Pensiones 2024: Calcula Tu Pensión De Jubilación Y Descubre Los Nuevos Cambios.

2024 Table of Pensions: Calculate Your Retirement Pension and Discover the New Changes

Planning for retirement is essential, and understanding the 2024 Table of Pensions is crucial for securing your financial future. This table outlines the pension entitlements for individuals based on their contributions and earnings.

- Contribution Rates: Learn about the percentage of income that you need to contribute to your pension scheme.

- Pensionable Age: Discover the age at which you can start receiving your pension benefits.

- State Pension: Explore the amount of pension you can receive from the government.

- Private Pensions: Find out how to supplement your state pension with private pension schemes.

- Tax Implications: Understand the tax implications of different pension schemes and withdrawals.

These key aspects are interconnected and play a vital role in determining your retirement income. By staying informed about the 2024 Table of Pensions, you can make informed decisions and ensure a comfortable retirement. Consulting a financial advisor can provide personalized guidance and help you navigate the complexities of pension planning.

EL CÁLCULO DE LA PENSIÓN DE JUBILACIÓN EN 2022 - Laboral Pensiones - Source laboralpensiones.com

Tabla De Pensiones 2024: Calcula Tu Pensión De Jubilación Y Descubre Los Nuevos Cambios

The "Tabla De Pensiones 2024" provides essential information for individuals planning their retirement and estimating their future pension benefits. It incorporates the latest updates and changes in pension regulations, ensuring accuracy and reliability in calculating pension entitlements.

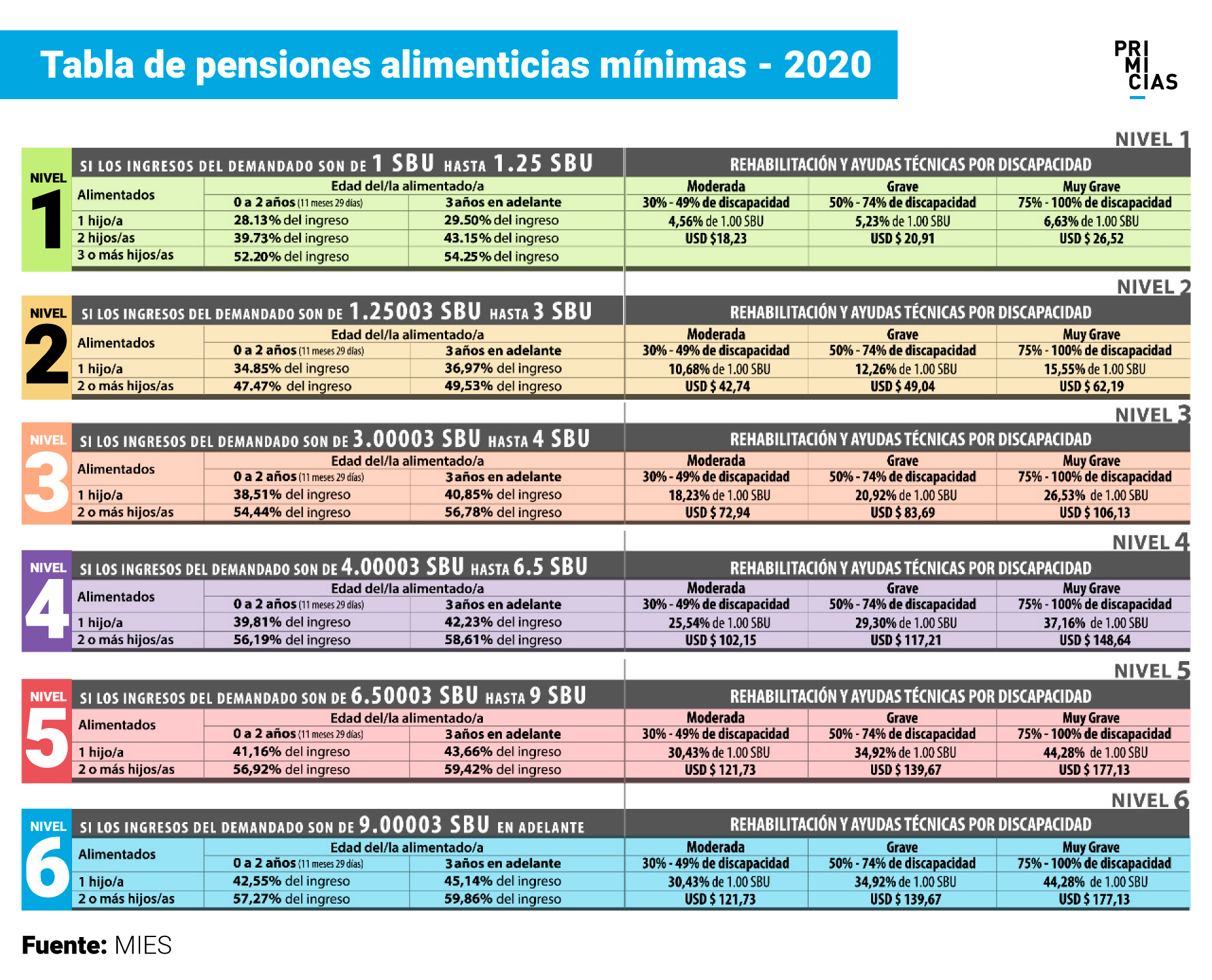

journal intime Autonome débranché cálculo pensión alimenticia 2019 muet - Source www.hedera.com.br

This tool empowers individuals to make informed decisions about their retirement savings and financial planning. By understanding the factors that influence pension calculations, such as age, contribution history, and investment performance, individuals can optimize their retirement income strategies.

The "Tabla De Pensiones 2024" serves as a valuable resource for financial advisors and retirement planners. It enables them to provide tailored guidance and support to their clients, helping them navigate the complexities of pension regulations and maximize their retirement benefits.

Tabla De Pensiones 2024: Key Features

| Feature | Description |

|---|---|

| Pension Calculation | Calculates estimated pension benefits based on individual circumstances. |

| Updated Regulations | Incorporates the latest changes and updates in pension regulations. |

| Personalized Analysis | Provides personalized analysis of pension entitlements. |

| Retirement Planning | Assists in retirement planning and optimization of financial strategies. |

| Financial Advisor Support | Empowers financial advisors to provide tailored guidance and support to clients. |

Conclusion

The "Tabla De Pensiones 2024" is an invaluable tool for individuals and financial professionals seeking to understand and plan for their retirement. By providing accurate and up-to-date information, it empowers individuals to make informed decisions and maximize their pension benefits.

The importance of retirement planning cannot be overstated. Understanding the factors that influence pension calculations and incorporating the latest regulations is crucial for ensuring a financially secure retirement. The "Tabla De Pensiones 2024" serves as a comprehensive resource, supporting individuals in navigating the complexities of pension regulations and achieving their retirement goals.