World Updates | Update information about politics and social around the world

Capitec Bank Fine SARB FICA Compliance: A Comprehensive Guide

Capitec Bank Fine SARB FICA Compliance: A Comprehensive Guide is a crucial document that provides guidance on the Financial Intelligence Centre Act (FICA) and the South African Reserve Bank (SARB) regulations for preventing money laundering and terrorist financing.

We have done extensive research and analysis to put together this guide, which we hope will help you to understand the FICA and SARB regulations and how they apply to you. We have also included some tips on how to comply with these regulations, to reduce your risk of being fined or penalized.

Key differences between FICA and SARB regulations

| FICA | SARB |

|---|---|

| Applies to all financial institutions | Applies only to banks |

| Requires financial institutions to identify and verify their customers | Requires banks to report suspicious transactions to the FIC |

| Imposes fines for non-compliance | Imposes fines and penalties for non-compliance |

Main article topics

- Overview of the FICA and SARB regulations

- How to comply with the FICA and SARB regulations

- Tips on how to avoid being fined or penalized

- Conclusion

FAQs

This FAQ section is designed to provide comprehensive answers to commonly asked questions regarding Capitec Bank's compliance with the South African Reserve Bank (SARB) Financial Intelligence Centre Act (FICA) regulations. These regulations aim to combat money laundering, terrorist financing, and other financial crimes.

Question 1: What are the key requirements of the FICA regulations?

Answer: FICA regulations require financial institutions to establish customer due diligence (CDD) procedures to verify the identity of their customers and assess their risk profile. They must also implement ongoing monitoring systems to detect and report suspicious transactions.

Question 2: How does Capitec Bank comply with the FICA regulations?

Answer: Capitec Bank has implemented a comprehensive FICA compliance program that includes:

- Customer identification and verification procedures

- Risk assessment and profiling

- Ongoing transaction monitoring

- Reporting of suspicious transactions to the FIC

SARB on Capitec | PDF | Free Download - Source www.slideshare.net

Question 3: What are the consequences of non-compliance with FICA regulations?

Answer: Non-compliance with FICA regulations can result in severe penalties, including fines, imprisonment, and the loss of banking licenses.

Question 4: How does FICA compliance benefit Capitec Bank's customers?

Answer: FICA compliance helps protect Capitec Bank's customers by:

- Reducing the risk of fraud and identity theft

- Preventing the bank from being used for money laundering or other financial crimes

- Safeguarding the integrity of the financial system

Question 5: What can customers do to support Capitec Bank's FICA compliance efforts?

Answer: Customers can support Capitec Bank's FICA compliance efforts by:

- Providing accurate and up-to-date identity information

- Reporting any suspicious transactions or activities

Question 6: Where can I find more information about Capitec Bank's FICA compliance?

Answer: More information about Capitec Bank's FICA compliance can be found on the bank's website or by contacting the bank's customer service department.

By adhering to these regulations, Capitec Bank plays a vital role in protecting its customers and the integrity of the financial system.

Refer to also SARB's website for further insights on FICA compliance requirements.

Tips

To ensure compliance with the Financial Intelligence Centre Act (FICA) and the South African Reserve Bank (SARB), financial institutions like Capitec Bank must implement robust and comprehensive measures. Here are some key tips for effective FICA compliance:

Tip 1: Establish a Clear FICA Policy

Develop a comprehensive written policy that clearly outlines the bank's FICA responsibilities, procedures, and risk management framework. This policy should be regularly reviewed and updated to align with regulatory changes and industry best practices.

Tip 2: Conduct Thorough Customer Due Diligence

Implement robust customer due diligence (CDD) procedures to verify customer identities, assess risk levels, and monitor transactions. This includes obtaining relevant documentation, conducting background checks, and understanding the purpose and nature of customer relationships.

Tip 3: Train Staff on FICA Requirements

Provide comprehensive training to all staff involved in FICA compliance to ensure a strong understanding of their responsibilities and the importance of adherence to the bank's policy. Regular training updates should be conducted to keep staff abreast of regulatory changes and emerging risks.

Tip 4: Implement a Transaction Monitoring System

Establish a transaction monitoring system to detect and report suspicious or unusual transactions. This system should be capable of identifying patterns and anomalies that may indicate money laundering or terrorist financing activities.

Tip 5: Conduct Regular Risk Assessments

Periodically conduct risk assessments to identify and evaluate potential risks associated with money laundering and terrorist financing. These assessments should consider the bank's customer base, geographical exposure, and products and services offered.

By adhering to these tips, financial institutions can effectively comply with FICA regulations and mitigate the risks of money laundering and terrorist financing. For a more comprehensive guide on Capitec Bank's FICA compliance practices, refer to the article Capitec Bank Fine SARB FICA Compliance: A Comprehensive Guide

Effective FICA compliance is crucial for maintaining the integrity of the financial system and combating financial crime. By implementing these tips, financial institutions can strengthen their compliance programs and contribute to a safer and more secure financial environment.

Capitec Bank Fine SARB FICA Compliance: A Comprehensive Guide

Capitec Bank's recent fine by the South African Reserve Bank (SARB) for non-compliance with the Financial Intelligence Centre Act (FICA) highlights the critical importance of adherence to regulatory requirements. This guide explores six key aspects of Capitec Bank's FICA compliance journey, providing insights into the complexities and challenges involved.

- Customer Due Diligence: KYC procedures to verify customer identities.

- Ongoing Monitoring: Continuous surveillance of customer accounts for suspicious activity.

- Risk Assessment: Identifying and mitigating potential ML/TF risks.

- Internal Controls: Establishing strong governance and policies.

- Training and Awareness: Educating staff on FICA obligations.

- Reporting and Disclosure: Prompt reporting of suspicious transactions.

These aspects are interconnected and crucial for effective FICA compliance. KYC and ongoing monitoring ensure proper customer understanding and risk identification. Risk assessment allows for tailored mitigation strategies. Internal controls provide the foundation for compliance, while training and awareness empower staff. Reporting and disclosure enable timely detection and investigation of suspicious activities.

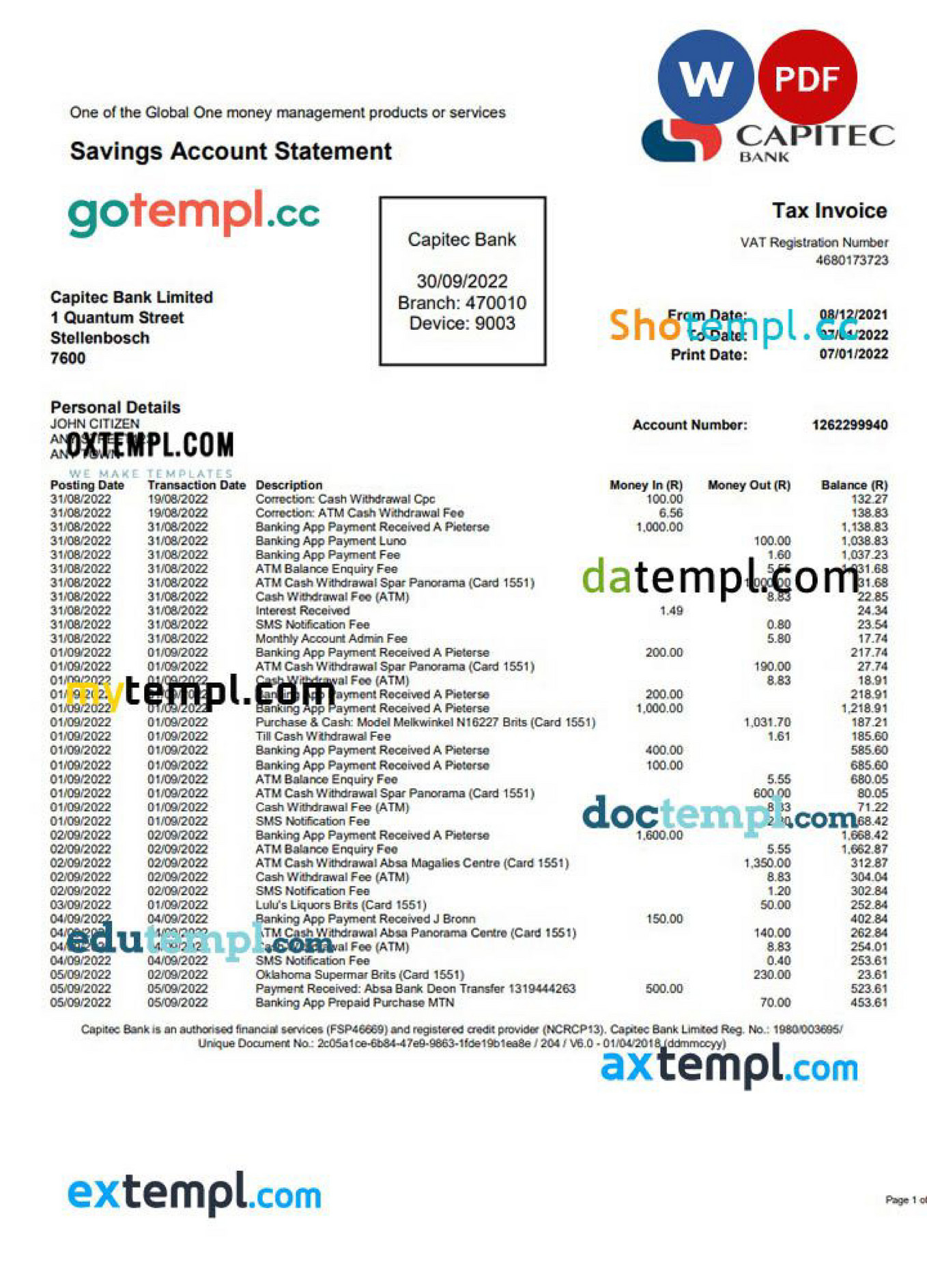

Doctempl - USA Capitec banking statement Word and PDF template - Page 1 - Source view.publitas.com

Capitec Bank's fine underscores the necessity of robust FICA compliance in preventing financial crime, protecting customer funds, and maintaining the integrity of the financial system.

Capitec Bank Fine SARB FICA Compliance: A Comprehensive Guide

In May 2022, Capitec Bank was fined R10 million by the South African Reserve Bank (SARB) for non-compliance with the Financial Intelligence Centre Act (FICA). The bank had failed to implement adequate measures to identify and verify its customers, and to report suspicious transactions to the Financial Intelligence Centre (FIC). This failure allowed criminals to use Capitec Bank accounts to launder money and finance terrorism. The fine is a significant reminder of the importance of FICA compliance for all financial institutions.

CAPITEC BANK IS HIRING BANK BETTER CHAMPIONS - Zar-Careers - Source zar-careers.co.za

FICA is a critical component of the fight against financial crime. By requiring financial institutions to identify and verify their customers, and to report suspicious transactions, FICA helps to prevent criminals from using the financial system to launder money and finance terrorism. The fine imposed on Capitec Bank shows that the SARB is serious about enforcing FICA compliance, and that financial institutions need to take their FICA obligations seriously. As financial institutions continue to expand and offer more complex products and services, the need for robust FICA compliance programs is only going to grow. Financial institutions that fail to comply with FICA face significant risks, including fines, reputational damage, and the loss of their banking license.

The Capitec Bank fine is a reminder that FICA compliance is not just a box-ticking exercise. Financial institutions need to take a risk-based approach to FICA compliance, and to implement measures that are proportionate to the risks they face. This means that financial institutions need to understand their customers and their business, and to tailor their FICA compliance programs accordingly.

Financial institutions also need to train their staff on FICA compliance, and to create a culture of compliance within their organizations. By taking these steps, financial institutions can help to prevent financial crime, and protect themselves from the risks associated with FICA non-compliance.